Online Access

Online Banking

We are thrilled to bring our members a brand-new online banking experience. This recently launched platform gives you access to your entire financial landscape and grants you the control to manage it the way you want to. With easy access to transfer funds, make loan payments, bring account information from other financial institutions into your profile, set financial goals, and see what offers you qualify for, there is so much you can do right from the comfort of your own home.

Use US Community Credit Union’s online & mobile banking platform 24 hours a day, seven days a week. It’s 100% free for our members.

Benefits:

- 24/7 Access from Your Computer, Tablet, and Smartphone

- Easily View Account Balances

- Make Transfers Between Accounts

- SavvyMoney & Credit Score Resources

- Account Aggregation

- View Your Credit Card Profile

- View Statements

- View and Print Tax Documents

- Pay Your USCCU Loan

- Access Online Bill Pay

- Set Up External Transfers

- …And So Much More!

How to Enroll in Online Banking

- Visit www.usccu.org and click “Login” or find the USCommunityCU app through your phones app store.

- Click “Register a New Account”

- Accept the Disclosure and hit “Continue”

- Confirm Your Identity (Account Number & SSN/TaxID Required)

- Verify Your Identity: You will recieve a one-time code via SMS text, email, or voice call to key in and complete verification.

- Create Username and Password

- Confirm Contact Information

- Turn on Biometric ID

- Turn on Digital ID

CONGRATS! You have successfully enrolled and will now be directed to your Digital Banking landing page.

Bill Payments

Take advantage of your recently upgraded Bill Payment Center to securely setup bills and pay them directly using your credit union account. Stop paying late fees or spending unnecessary money on stamps. Through this feature in online and mobile banking, you can schedule your bills to be paid automatically at a future time.

Benefits:

- 24/7 Access from Your Computer, Tablet, and Smartphone

- Pay Bills From Your USCCU Account

- Schedule Payments in Advance

- Securely Store Merchants for Recurring Payments

- Create One-Time Payments

- Save Time, Money, and Gas!

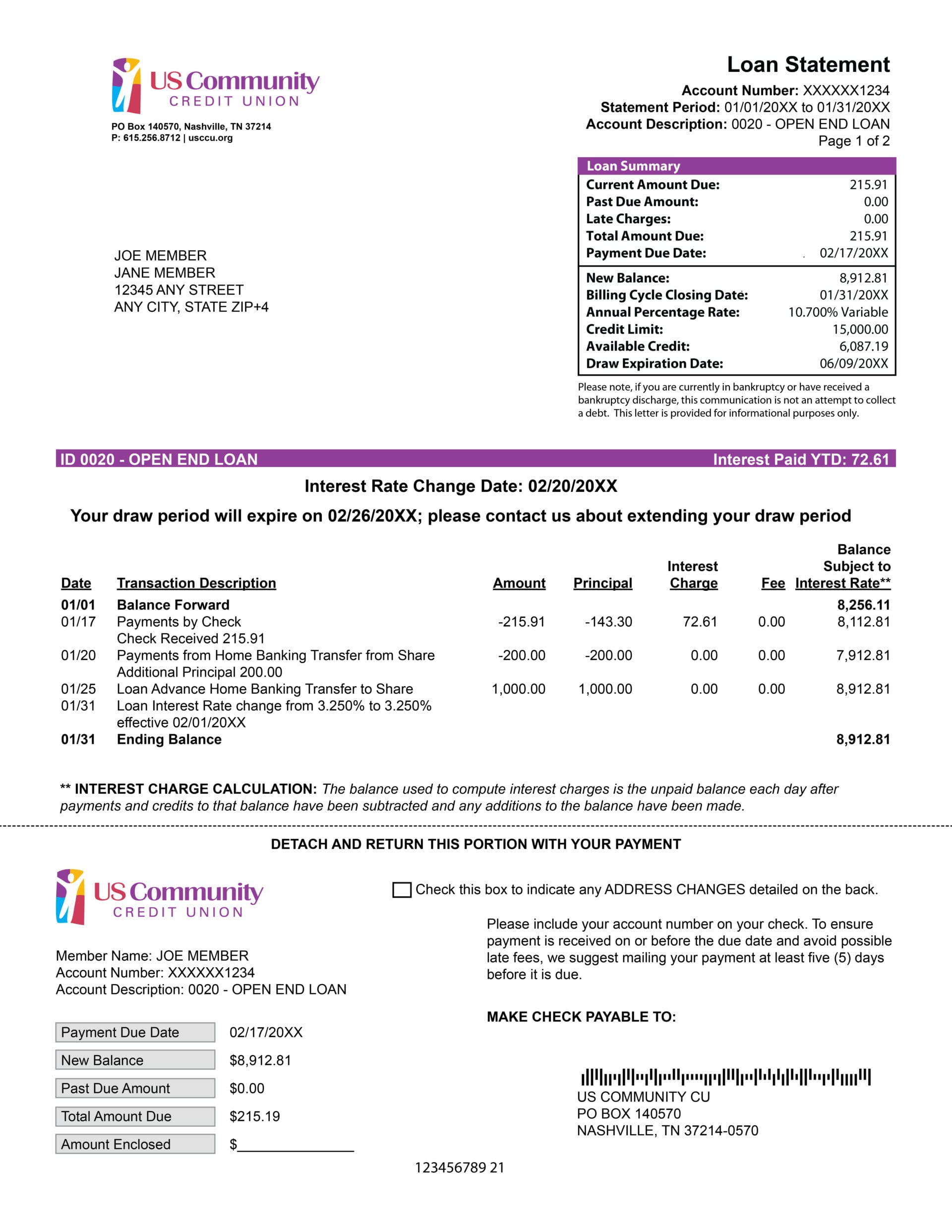

e-Statements

Introducing USCCU’s newly designed e-Statements platform, the ultimate solution for streamline financial management. Through this platform, members can view and print account statements, tax documents, notices, and more, all in one convenient spot. Accessible through both online and mobile banking, this user-friendly interface puts everything you need right at your fingertips.

Say goodbye to scattered statements and hello to seamless organization. Experience the ease of efficiency managing your finances today.

Benefits:

- e-Statements are FREE!

- Secure Access Through Online & Mobile Banking

- Convenient Anytime Access

- Account Statements

- Mortgage Statements

- HELOC Statements

- Tax Documents

- Notices

- Plus, No Risk of Lost or Stolen Mail

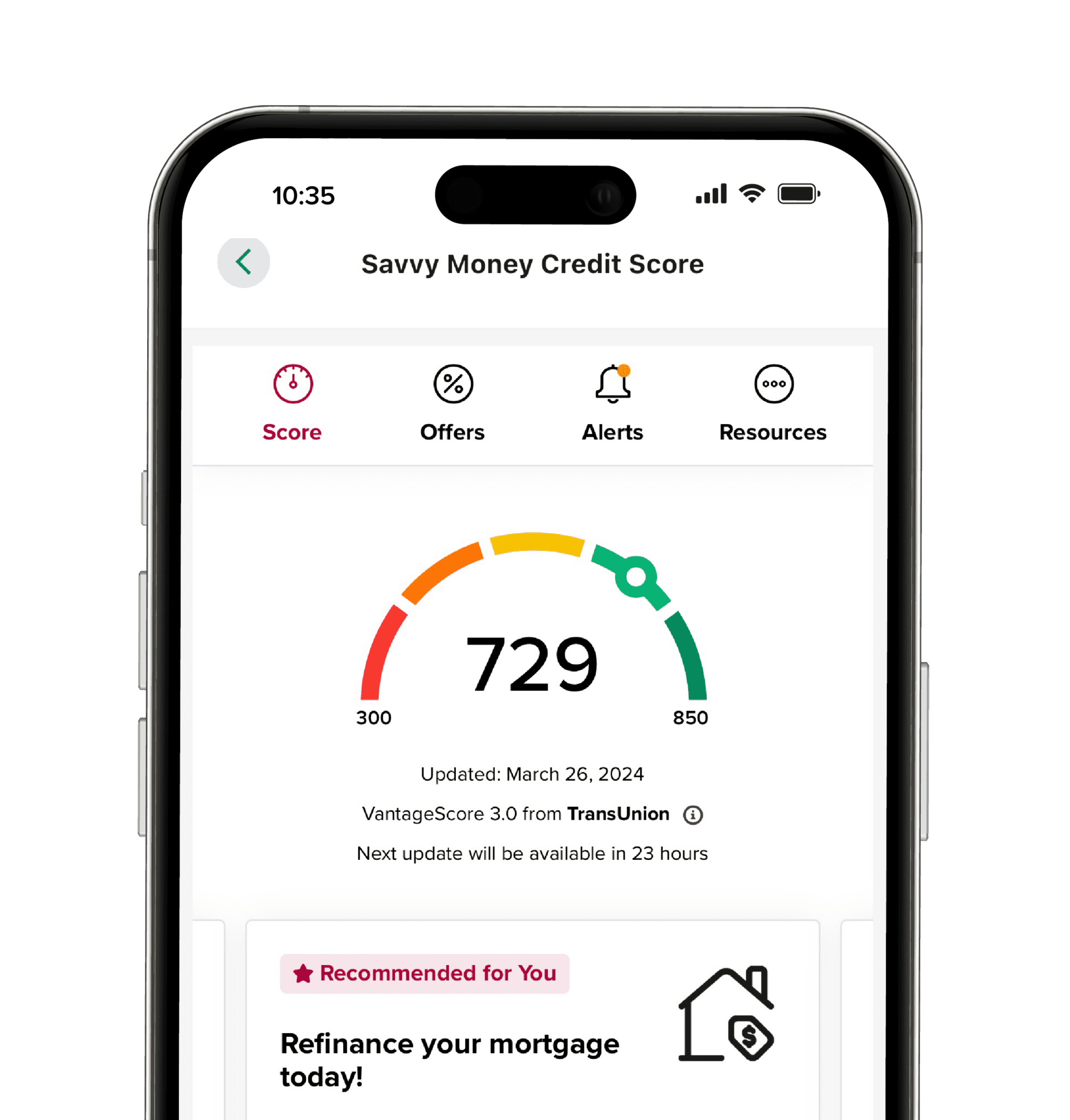

SavvyMoney®

Introducing SavvyMoney – your ultimate financial ally. This free feature for USCCU members allows you to discover smarter ways to manage money, track credit, and achieve financial goals with ease. SavvyMoney quickly and easily provides personalized credit insights to help our members take control of their financial journey.

Benefits:

- Easily Accessible Through Online & Mobile Banking

- 24/7 Access

- Personalized Credit Insights

- Debt to Income

- Budgeting Tools

- Personalized Product Offerings

- Credit Monitoring

- Financial Education

- Debit Management

- Goal Setting

- …And So Much More!